Ryan Rutan

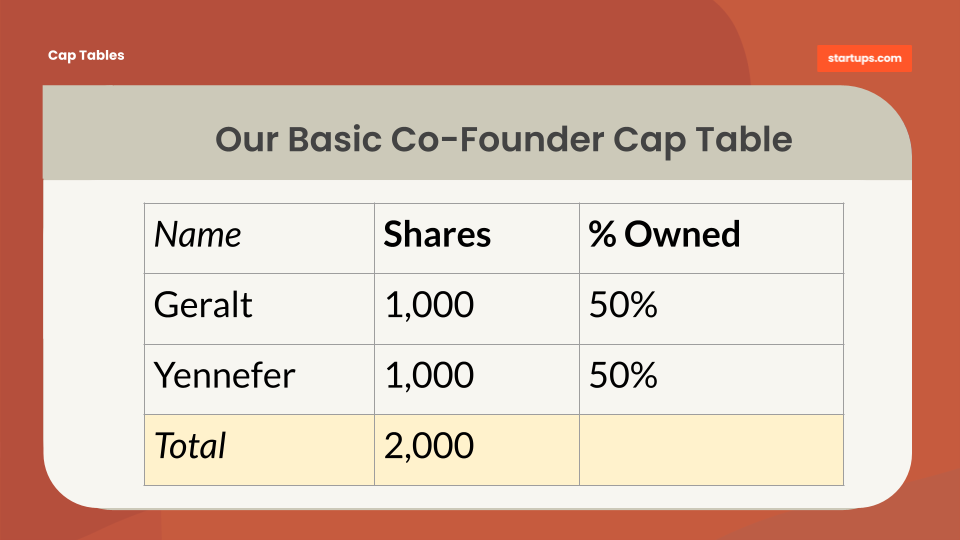

A capitalization table or "cap table" is a record of the equity ownership and actual ownership percentage of each member of the company. Private companies typically develop a cap table when they are first formed to capture the stock ownership of the co-founders and then later begin recording stock ownership of employees, advisors, and investors.

Why do Startups need Cap Tables?

The moment the number of shares in our startup expands to more than one owner, we typically create the company's cap table. This is just a ledger of where the company's ownership stands and can be captured in something as simple as a spreadsheet.

As our startup expands, cap table management becomes more complex, such as when we take on a funding round with a venture capital investor and the value of these ownership stakes becomes significant. We also will begin issuing stock options to employees where we'll need an updated cap table to understand how many individuals have an ownership stake in the company.

How often is a Cap Table Updated?

A startup's capitalization table tends to get updated whenever the number of shares changes or by way of that the ownership stakes change.

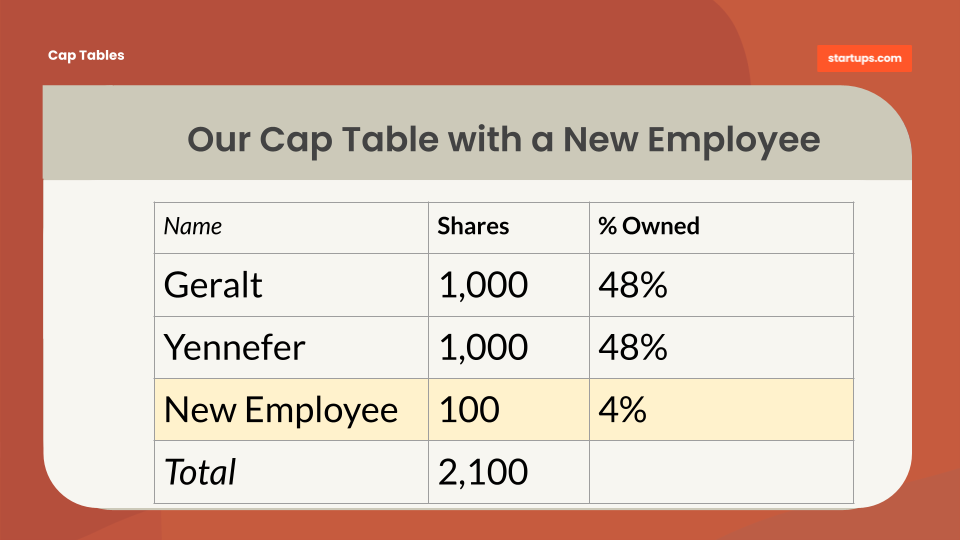

For example, let's say that our 50%/50% cap table existed between the co-founders of the company and we take on an employee we want to give shares to.

At that point, we would update the cap table to show our ownership dilution (we have less) and the total authorized shares for the new employee (they have more).

Adding a New Employee to the Cap Table

Notice how we have a new entry into the capitalization table. We've issued the "New Employee" 100 shares of the company which nets them 4% (the actual percentage is a little higher) of the company.

At the same time, the ownership percentage of Geralt and Yennefer, the founders, drops by an equal amount to 48% each. These are obviously major company decisions because they will continue to affect the company's stock for all shareholders.

What do Investors Expect in a Cap Table?

If we're going to be raising money from angel investors, venture capitalists, or any outside investors, they will certainly ask for our capitalization table. They are specifically buying stock in the company and need to know how their ownership percentage will be affected by their invested capital.

Investors will expect to see all members of the cap table, including key employees, stock options, and the company's founder's ownership in detail. If there have been previous investors they will expect to see their fully diluted ownership stakes as well.

Can a Spreadsheet Work?

The cap table can be presented in a spreadsheet if it's simple or others will use dedicated cap table management software if the stock issuances start to become more complex (think 50+ shareholders, and upwards of 500+ in some cases).

There's nothing wrong with using a spreadsheet so long as we're able to keep up with the math and ensure the number of shares is accounted for properly. That said, once we have to start working with complex terms like liquidation preferences for investors or how preferred equity shares may work differently from common stock, a spreadsheet becomes unwieldy.

What about Convertible Debt?

In our early funding rounds, we may take on Convertible Debt (or "convertible equity") which is essentially a loan that converts to equity ownership in later financing rounds with new investors.

We cannot accurately create an updated cap table until those future financing rounds have been completed because the price and quantity of those shares have not yet been determined. However, once the new securities have been determined and the investor's percentage can be calculated, we will be able to show the fully diluted value of those new shares.

At that point, the economic ownership of the convertible debt investors converts to preferred stock (usually) or common stock and will be treated like any other investment.

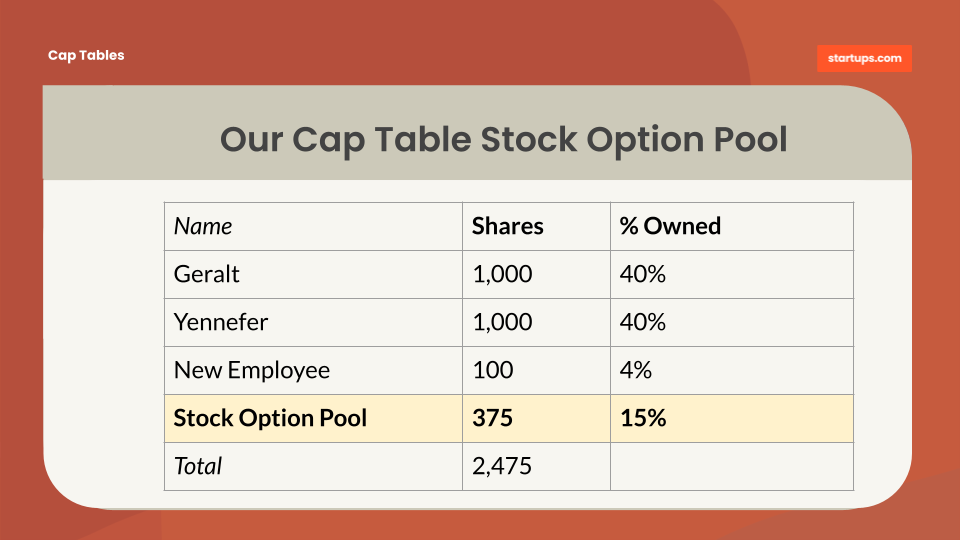

How are Stock Options Recorded?

Most early-stage businesses that have created employee stock options will create what's known as an Employee Option Pool which is essentially a placeholder for share issuances.

For example, a startup will often set aside 15% of the total shares of the company for future awards. By pooling all of these awards into a single basket, each award is simply listed within that 15% placeholder instead of listing and adjusting every single employee that may come in and out of the cap table.

Notice how Ownership Dilution Calculates

As shown here, our Stock Option Pool is set at 15% and dilutes Geralt, Yennefer and a previous New Employee who may have been awarded stock before the Stock Option Pool was created. Each of those previous holders will have their ownership diluted whenever a new "event" has happened such as taking on other investors.

A separate register could be created for just the list of awarded employee stock options - which could be hundreds of entries — but again only listed as a single line item in our capitalization tables.

Who Maintains a Capitalization Table?

The setup and maintenance of the company's cap table will usually start with an attorney if available and then shift to the Founders in the formative years. That's simply because there often won't be much meaningful activity — yet.

The most common cap table managers would be a startup's attorneys, the Founders, and/or the CFO or head of finance if they are capable. Managing the ownership structure is an ongoing process and the only system that works best for one company may not work best for another.

When is the Cap Table Most Important?

Ultimately in a liquidity scenario where any private company either is sold or goes public, the cap table becomes paramount. While there are many scenarios prior to a liquidity event that a new company will reach for its cap table, the final "waterfall analysis" is what matters.

If the company sells, no matter what the company's stage, all of the shares owned will be converted from preferred shares to common stock. A law firm will likely do an intricate breakdown of this activity including special items like restricted shares or terms from other investors.

What if the Cap Table gets Complex?

As the cap table becomes more complex and recording stock ownership goes from a few line items in a spreadsheet to "way more than anyone can handle," startups will use cap table management software such as Carta or Shareworks.

In the early stages of a new business, we really don't have to stress about this. The total cost of managing our cap table should really be zero because it's "just us." But over time once we start dealing with convertible notes and other more complex structures, especially with multiple funding rounds, it's nearly impossible to do this manually.

Can we just outsource this?

Yes, we can also outsource this. In much the same way an outside accounting firm may maintain our balance sheet, our cap tables can usually be handled by a reputable law firm, though hourly billing is an expensive way to do it!

Cap Table Template

There are a ton of cap table templates that you can download to get started on this process if you want to dig in yourself, or if you just want to see what cap tables look like in general. Again, most cap tables start off very simply with just a

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

Submission confirms agreement to our Terms of Service and Privacy Policy.

Already a member? Login

No comments yet.

Start a Membership to join the discussion.

Already a member? Login