Wil Schroter

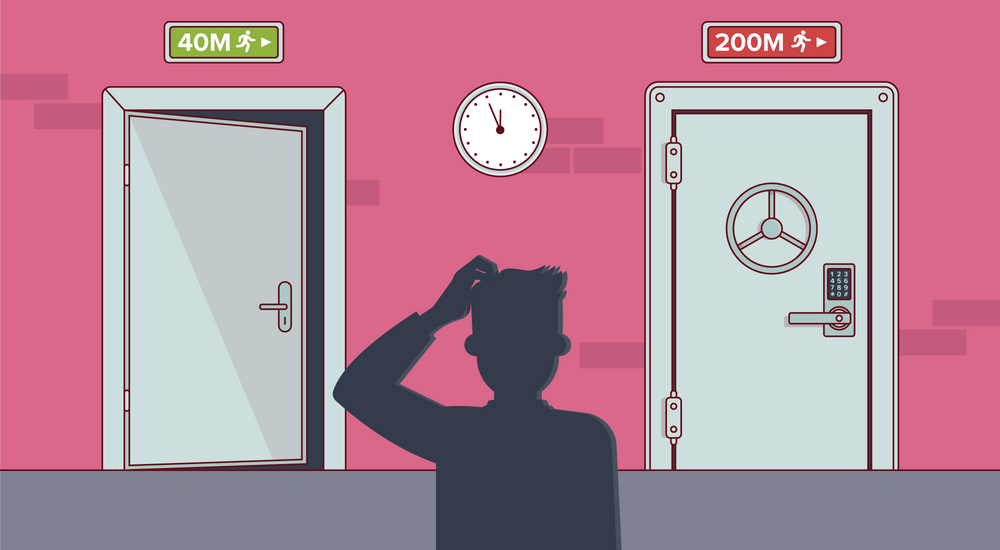

What if I told you that selling a company for $40 million could net you more money than if you sold it for $200 million?

On its face, it sounds ludicrous, I know! But what's missing in that formula isn't the exit price, but how much of that exit we get to put in our pocket as we raise more rounds of capital.

More importantly, our opportunities to sell for $40m are dramatically more abundant than selling for $200m (or more!). That means every time we raise capital, while it sounds like we're improving our chances of an outcome, we're also reducing our options to find an exit at all.

Real Founder Dilution Numbers

CapShare released a study of 5,000 startup cap tables to determine how much equity Founders have at each stage of a funding round. To keep this simple, we're going to look at two moments in time — our "Seed Stage" (which is typically $500k — $2m of funding) and our "Series D Stage" ($50m or more in a single round and often the last round of funding before sale or IPO).

At Seed Stage, the average Founder Pool has diluted to 60%. We will assume we have 3 Founders, so each Founder holds 20% of the whole company. If we were to sell the company for $40m at that point, we'd each get a check for $8m. Not bad.

But that's just the beginning. Now imagine we did "everything right" in our fundraising and made it all the way to our Series D round. On average, each of us would have about 4% of the company. That means it would take a $200m sale for us to net the same as a $40m sale.

But Wait, There's More!

If you were quick with your math skills you may have noticed that those two outcomes are the same for Founders when I specifically stated the $40m exit would net more. That's because we're not counting a hidden but important gem in the fundraising process called "Preferences."

For those unfamiliar, "Preferences" are what investors add to their deal to help them recoup their initial investment first before the rest is doled out to everyone, including us. For example, a startup that raises $10m from a VC may have a $10m preference attached. That means no matter what the startup sells for, the VC gets their $10m first, and then everyone else gets paid.

Now imagine there was a stack of preferences added at Seed Stage, Series A, Series B, Series C, and Series D which is all the capital that the company has raised. That total preference could easily top $100m or more. This means if the company sold for $200m, the first $100m would go directly to investors, and then the remaining $100m would be split up based on our equity shares. So our 4% stake would look more like $4m, not $8m, which is half of what the Seed Stage $40m sale would have netted us!

Our Probability of Exit Shrinks

As we raise successive rounds and our ever-important Valuation increases, our first thought is "Oh wow, I'm worth so much more!" And there is a bit of truth to that. But what we don't immediately see is that we just narrowed our number of options to actually sell the company geometrically.

In order to achieve the same outcome as we needed in our Seed Round (the $40m) we now have to sell for 5x more ($200m) to get what will likely be a lower outcome. Fundamentally there are far fewer companies that can write a $200m check than those that can write a $40m check. Not only that but when we get into $200m+ territory, there are very few companies willing to take a chance they got it wrong.

What's really happening behind the scenes is that as Founders, the more money we raise, the more challenging it becomes to find a probable exit that we can benefit from. Yes, more money helps us build a better company (in theory), but if what we're doing in the end is geometrically narrowing our window to benefit from it financially, was it really the right move?

In Case You Missed It

What We "Lose" When We Sell Our Startup Let’s talk about the emotional toll it takes on Founders when they sell their business, how to spend time when the Startup is gone, losing authority & level of importance, and if there’s a way to prepare to become an ‘exited’ Founder.

How Do I Get People to Take Me Seriously? (podcast) Join Wil and Ryan as they take a deep dive into why it takes so much work to be taken seriously as a new Founder and what we can do to thumb the scales in our favor.

What Are the Most Important Skills a New Founder Needs? Most Founders have a "certain set of skills" that apply to one aspect of their startup. Unfortunately, we sort of need to be a jack of all trades because we're often the only person doing all the work! But what are the most important?

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

Submission confirms agreement to our Terms of Service and Privacy Policy.

Already a member? Login

No comments yet.

Start a Membership to join the discussion.

Already a member? Login