The Startups Team

The Funding Slide in our investor pitch deck summarizes our investment opportunity, including our use of funds, investment amount, and what we want to accomplish in our next stage. Potential investors, from angel investors, to venture capitalists, will zero in on this part of the slide deck to determine their initial investment.

Typically this is the final slide of an investor pitch deck, where we transition from pitching investors to making the big ask.

What do Potential Investors want to know?

Our investor deck should cover three critical factors when we get our "ask slide":

"How much capital? What Round of capital?"

Many investors, from venture capitalists to angel investors, align their investments based on the amount of capital a startup company is raising, which implies what stage of their fundraise they are at (pre-seed, seed stage, and Series A are most common). We of course want to make it clear exactly what we're raising.

"What are the Use of Funds?"

When raising capital for our business idea, every investor will want to know how the management team intends to use the funding to grow the business. Our pitch deck should detail how we plan on scaling our business model using our capital and all the resources we're requesting.

"What will this round achieve?"

Every funding round with new and existing investors is intended to achieve a particular milestone in our overall business plan.

That could be scaling the company's team, driving user growth in our target market, or juicing our revenue model. These milestones are exactly what potential investors want to see to spark interest in an investment.

We want a Super Tight Pitch Presentation

Remember, potential investors are scanning through hundreds of pitch decks looking for a single market opportunity that makes sense. The competitive landscape for raising capital is intense, so we want to make sure our entire pitch deck is as buttoned up as possible. Fortunately, we've got a few slide examples of the perfect formula.

The "Perfect" Funding Formula

The key to a stunning pitch deck is to provide investors with this simple formula:

"We need this funding to acquire these resources to accomplish this outcome."

Once you understand what each of the elements means to an investor, creating your own ask slide is actually pretty simple.

Step 1: Funding Amount & Stage

We'll begin by clearly stating the amount of funding we're seeking and the stage of funding. The funding amount is simple — it's the amount of capital we're seeking for this particular investment opportunity.

If you're unsure about how much funding you should be looking for, you can at least get a ballpark number by comparing your progress to the "stage" of funding (explained below). Startups tend to invest in progressive stages, from pre-seed to Series A and beyond, with each stage representing a range of capital that investors provide.

Understanding your Funding Stage

Most investors will identify their investment opportunity by "stage," which is a typical amount of capital a startup will raise. For example, a venture capitalist like Sequoia Capital will typically invest in "Series A" deals primarily ($3m+) whereas other investors may write smaller checks in a pre-seed "idea" stage pitch deck of $100k.

3 Major Funding Stages

Pre-Seed Stage - First $0-500k, typically from angel investors, startup accelerators, and friends.

Seed Stage - $500k - $3 million, from angel investors, and small venture capital firms.

Series A - $3 million+, almost exclusively from venture capital firms.

Here's how we would combine our funding amount and funding stage:

“We are raising $1.2 million in this seed stage round.”

Being deliberate about what round we're raising is important as well because the amount we're raising doesn't always sync with the stage of capital.

Why does this matter? Investors want to know if we've raised capital before, from whom, and how much. Typically if we are indicating we are raising a "Series A Round" then we've likely raised a Pre-Seed and Seed Stage round as well.

"What if we ask for too much? Too Little?"

Throughout the fundraise we will likely make tweaks to our fundraise amount as we get more feedback and learn more from investors, so it's OK if we set a target raise now and adjust as we go. Unless we jump from $250k to $5 million we're probably going to be OK!

What about Valuation?

We generally don't specify our valuation in our pitch deck for a couple of reasons. First, over the course of our fundraise the terms of our investment opportunity refine our target market of potential investors and learn more about what valuations they are willing to pay.

This tends to be negotiated outside of the pitch deck in person, so "rubber stamping" it into the deck usually isn't a great idea.

Investors will only ask about our valuation if they are interested in making an investment, so until they kick off that conversation — which we hope they do! — we can table this conversation.

Step 2: Use of Funds

After our slide explained the amount and stage of funding, we then move on to detailing our "Use of Funds." These are the biggest categories of spend for our given period of investment — not every last dollar we'll manage. Just a few bullet points will do just fine.

Investors are mainly interested in how these categories of spending will drive our upcoming outcomes (which is our next step).

Example of Use of Funds in a Slide Deck

Our intended Use of Funds:

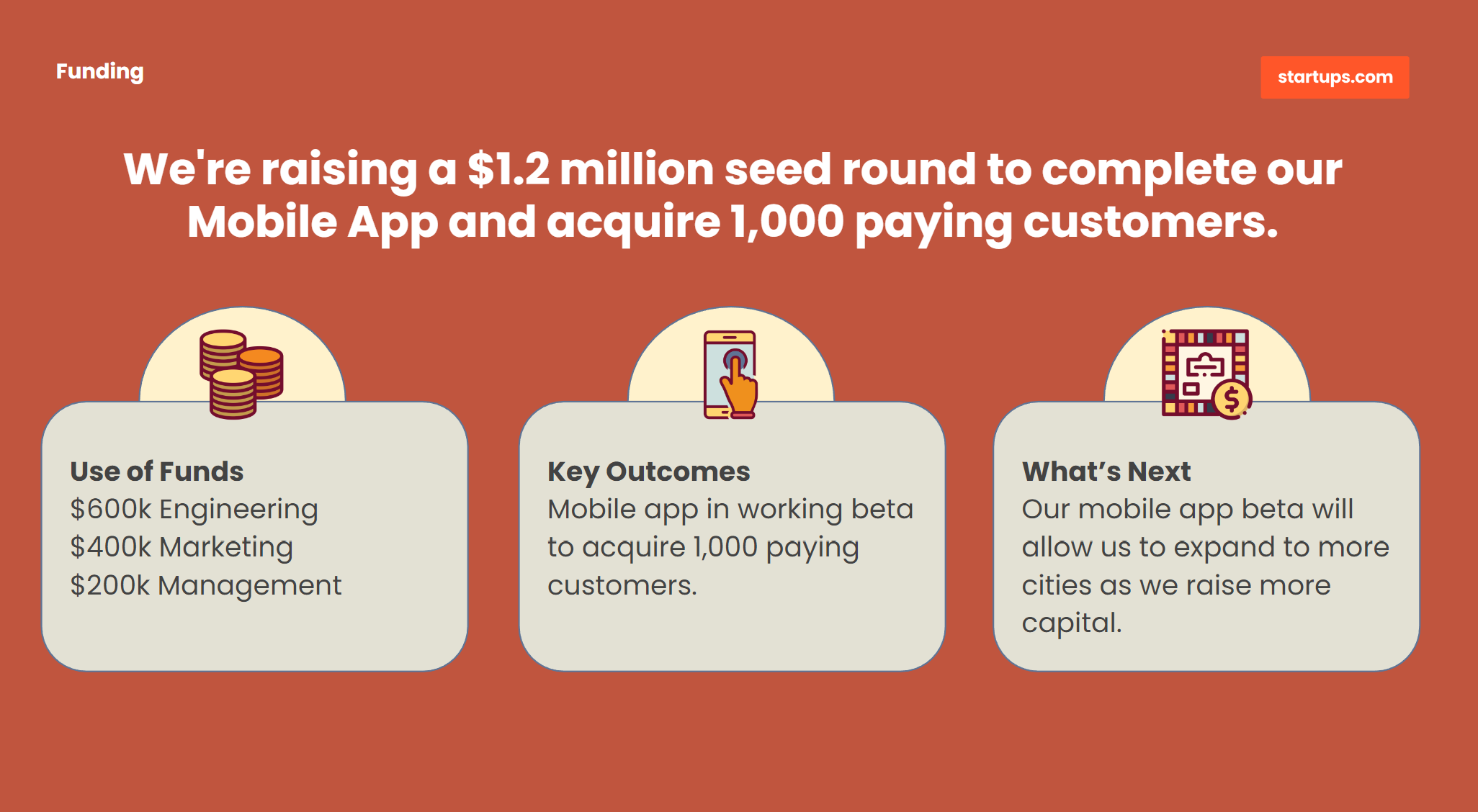

$600k Engineering

$400k Marketing

$200k Management

We can expand upon this in our in-person pitch, but for now, investors just want a general idea of where the money will go. We're also going to have more detail about our spending in our Pro Forma Income Statement (an addendum to our pitch deck) and in summary form on our Financials Slide.

The Categories tell a Story

Investors are actually going to respond more aggressively to the categories of spend than anything else, which could be triggered by other slides.

For example, they may look at your Competition Slide and determine that your marketing spend needs to be the bulk of your budget for a given period. We use the ask slide and the associated categories to begin that conversation, not answer every possible question.

Step 3: Outcomes

Our Outcomes justify the investment by showing how our capital will drive the business model forward, and to what end. This should also be brief, ideally focused on the 1 or 2 major milestones that this fundraise will drive.

Remember that investors typically aren't expecting this to be the last time we raise capital! Most often our next outcome is to achieve some momentum to set up for another fundraise. Our pitch deck should reflect that goal as well.

The most common outcomes tend to be:

Break-even or profitability

First generation of the product

Customer growth milestones

Major assumptions tested and proven

Here's how we would present our intended outcomes:

“We’re looking to complete our mobile app and acquire 1,000 customers.”

With this simple sentence, an investor can easily understand exactly what their money will buy, with the intent of course that we'll have future milestones that may require additional funding.

Setting the General Direction

Our outcomes should also set the general direction of the startup post-funding and post-execution of that funding.

Often this will involve expanding past an initial market or expanding the feature set of the product. What investors are looking for is where we're headed post-funding.

Funding Slide Examples

Now let's put all of these elements together using the elements we explained earlier.

We always open each slide of the pitch deck with a single, declarative sentence that sets the tone for the rest of the slide. In this case, our summary is "We're raising a $1.2 million seed round to complete our Mobile app and acquire 1,000 paying customers."

Let's stop there for a moment! Even if we had no idea what the rest of the slide explained, as potential investors, we would understand exactly what our startup was trying to accomplish. That alone is worth its weight in gold!

Supporting the declarative sentence would be our key milestones in the ask slide that will drive the investment forward. If we're in the middle of a raise we may also add what existing investors will be participating in this round, but that's entirely optional.

Keep it Simple

We have a tendency to want to load this slide up with tons of data that, frankly, no investors are asking for. The slides shouldn't try to explain every last possible detail of our fundraise, just align investors to the basics so they can pose questions.

From a layout standpoint, we're optimizing for single phrases and bullet points wherever possible. There's not a lot of room here for long narratives — just the basics!

What's next after this round?

While not required, we may also want to indicate what will happen after this milestone. For example, we may append our outcome as such:

“Our mobile app beta will allow us to expand to more cities as we raise more capital.”

While we may be building an online service the larger goal could be how we expand the product physically, so demonstrating we can move into other markets may be important to cite here. In other cases that goal might be to bulk up our balance sheet to start making acquisitions, which we would also cite.

How far out do we need to predict?

Investors are typically looking for a funding forecast that will give us 18-24 months of runway before we need more funding, or ideally, begin to reduce our burn rate with actual revenue. We're rarely ever raising "forever capital" (although that would be nice) but just enough to get us through this next milestone.

In addition, investors know that so much will change in the formative stages of our startup that being able to accurately predict our needs or expenses beyond the first year or two is nearly impossible.

What Questions to Expect

There are two "rounds" questions that we should prepare our pitch deck for — the ones they ask when scanning our deck alone and the ones they ask during our presentation. No one has such a stunning pitch deck that investors have zero questions and just write a check!

"How long will this round last?"

Even if we spell it out in our pitch deck, investors are still going to grill us on the ask slide because they want to know — from our mouths — how we defend our projections.

"Why are you spending so much money on X?"

Assume every investor has had some experience or issue with a specific type of spend, from a previous portfolio company that spend too much on marketing or perhaps got burned on sales. So naturally, they are going to dig in. If you don't have the "perfect answer" right away, don't sweat it. Let them know you'll research, get the answers, and follow up with a strong response.

"Who is your lead investor?"

If you're not familiar with the term "lead investor" it means the investor who is going to manage all of the terms of the deal on behalf of the other investors, as well as lead the due diligence of the company. Most investors don't want to be the lead investor (it's real work!) so they are asking if someone else is committed. It's also an indication that someone else will vouch for the company.

"How many other investors do you have on board?"

This is a trick question! It's not meant to be, but what an investor is really asking is "Is anyone but me putting money into this idea?" Investors do not like to invest by themselves, so hearing that they are the first or only investor is never a good sign. The best answer is to punt and say "We have a few others looking at this deal that we can share later." It's better to get to that at a later date, with ideally a whole bunch of investors to respond with!

Common Mistakes to Avoid

The pitch deck formula for presenting our ask is pretty easy to follow, but we'd also like to take a look at a few common mistakes we see at Startups.com.

We see thousands of pitch decks but we're always reminded that most Founders are raising money for the first time and "learning on the job!" We get it — we did the same when raising for our own startups.

Don't Guess! Just Ask Us

Probably the most consistent advice we give to Founders — on anything — is "Don't guess at any of this stuff! This has all been done a thousand times before you. Ask us (or other Founders) what to expect, how to structure your pitch deck, and what to say. We'll gladly give you the answers to the test!

Not the Last Round

We have to present our investment opportunity as if this is likely one of many rounds of capital. In some cases, it may not be, so this isn't a "given" but many entrepreneurs don't realize investors anticipate more rounds.

The old way of thinking goes "If things go well, we'll need more money to scale. If things go poorly, we'll need more money to survive." Either way, we'll need more money!

Don't Promise Returns

Startups are highly speculative, and most startup investors understand that the promise of a return is nearly impossible to predict. Modern pitch decks don't have investment returns promised in them, so don't feel pressure to add them.

Raise Way Sooner than you Need to

This is less about your pitch deck and more about fundraising as a whole but it's so important that we wanted to include it. A successful fundraise (even with the most stunning pitch deck) is still going to take 3-6 months — best case. So the sooner you get out there and raise, the better!

Use the Ask Slide to Start a Conversation, not "Seal the Deal"

The amount of capital we're seeking in our "ask slide" doesn't have to be the final answer. Startups change their funding amounts all the time as they understand market conditions and investor interest.

Don't worry about whether you "got the number perfectly right" because it's just the starting point for a conversation anyway. The investors are going to use the deck mostly as a way to frame what's in your mind.

But there's a significant amount of conversation that happens during and after the pitch deck presentation that actually shapes the real fundraise. No one is going to look at our deck and say "That's all I need, here's my money!" (Although that would be nice!)

Instead, we'll have multiple rounds of conversations. The first will be after we've e-mailed our deck where an investor will give us a basic idea of their interest.

After that, we'll likely have an in-person conversation where we go into some more details and semantics of the ask slide and our fundraising goals.

And if that's not enough — we'll then go into it all over again during due diligence before our close. So take a breath friends — we have plenty of time to talk about these terms!

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

Submission confirms agreement to our Terms of Service and Privacy Policy.

Already a member? Login

No comments yet.

Start a Membership to join the discussion.

Already a member? Login