The Startups Team

The Pitch Deck Traction Slide helps showcase early traction when we pitch investors. But what kind of traction metrics matter to investors? Let's walk through some common pitch deck traction slide examples showcasing user growth, growing revenue, and scaling active users.

Also, if you're concerned about showing traction in your pitch deck, don't sweat it. We'll show you how to position your traction slides even if you're pre-revenue.

Traction Slide Pitch Deck Formula

The perfect traction slide pitch deck formula incorporates three investor questions into a single slide:

Product Progress + Customer Acquisition + Visible Growth = Traction

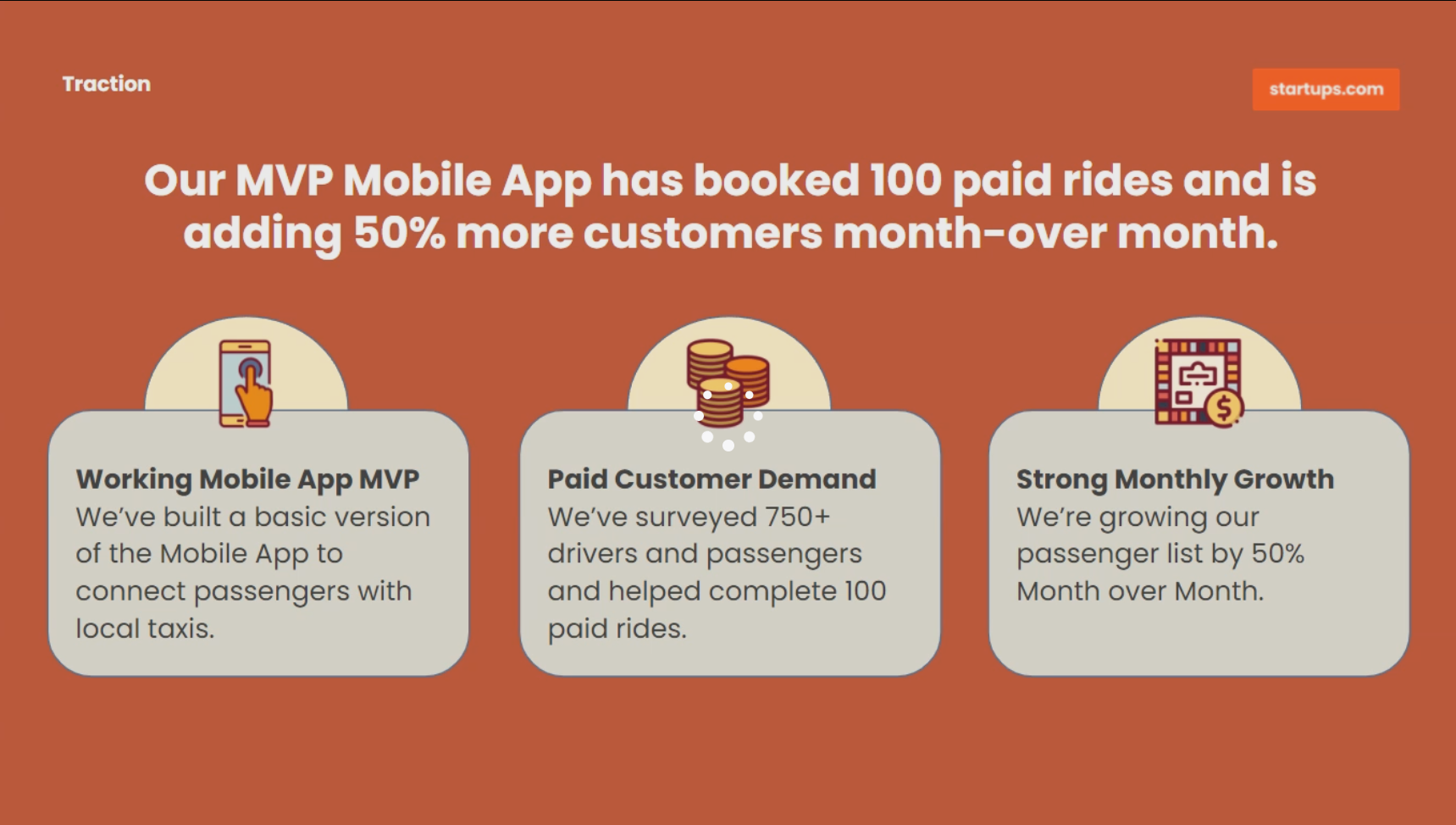

The most stunning pitch deck examples incorporate all of these factors into their traction slides. Let's look at a successful example of how we work each of these into our pitch deck.

What's an Investor Thinking?

We always approach our pitch decks (and in this case the traction slide) with what an investor cares about. We know investors care about customer traction and our growth rate but what are they looking for specifically? Our traction slide pitch deck focus needs to be on point.

Product Progress: "How far along is the product?"

Our product progress varies greatly from pre-seed to seed round funding, so investors will zero in on what kind of progress the founding team has made on an actual product. Product progress is important for showing traction but if we're still early we can showcase the traction slide differently.

Every startup has some level of product progress, and our pitch decks have to reflect how far along our startup company is in the market. Note that we don't have a fully formed product to get an investment; most startups are still conducting pilot studies when they are going after their pre-seed round prior to demo day.

Here's an example of how Uber would present their progress even with test users:

"We've built a basic version of the Mobile App to connect passengers with local taxis."

We need to focus on explaining just enough to investors so they can triangulate our progress and move on through the pitch deck. We don't need to go into insane detail.

Customer Growth: "How many customers do they have?"

Early user growth traction metrics create confidence in our pitch deck. Even a few examples of generating sign-ups, pre-orders, or ideally sales are good indicators. For many startups, user growth and the marketing metrics that drive them will be the hallmark of a traction slide.

Here's an example of Uber's customer growth even at small levels:

"We've surveyed 750+ drivers and passengers and helped complete 100 paid rides."

Small Customer Traction is still Traction

Any early traction is meaningful in our traction slide so don't assume our user growth has to be insane. We want investors to look at this slide and think "Customers obviously love this product and if they love it now, they'll love it a lot more when we invest some capital!"

Showing Growth: "Are they generating revenue?"

Obviously seeing revenue in our traction slide going "up and to the right" is seen in a positive light, but the predictability of it (monthly recurring revenue) is also worth highlighting in our traction slide.

Investors are looking for trends that we can build on with investment. For example:

"We're growing our passenger list by 50% month over month"

An investor will read this as "Even if the numbers are small the growth rate is something we can build upon". That's the kind of incentive we want to create in our traction slide - greed!

No Revenue? No Problem

Many startups are "pre-revenue" and therefore will focus their traction slide on other types of growth metrics. We can show growth in our business through sign-ups, early commitments, successful engagements, and even user surveys. What matters is that the business is growing, even if it's not just revenue.

Traction Slide Sample

Now let's take all three of these categories and combine them into our Traction Slide. Notice that we're opening the slide with a single declarative sentence that's easy for investors to digest and then highlights each category of traction separately.

A prospective investor can scan this quickly and assess our progress across Product, Customers, and Growth. The key to every stunning pitch deck is: simplicity.

Other Types of Traction

There are other types of traction that we can showcase in our presentation — they just matter less. Here are a few other categories startups use in their traction slide:

Press & Media Mentions

Getting in the press used to mean less than it does today since most media has moved to social media and the bar to get there is nearly zero. Still, some third-party validation of the press doesn't hurt either.

Key Hires & Advisory Board Members

Landing a key hire like a CTO or big name Advisor is great, and sometimes they indicate a major bit of social proof for the company, but keep in mind that nearly every other pitch deck is featuring another startup having done the same. It doesn't hurt, but it may not move the meter with investors.

Big Partnerships

Getting a Letter of Intent or signing a big partnership is great if they can directly tie toward revenue growth in the near term, but unless they are currently bearing fruit, they often go overlooked.

Conclusion

As we said earlier, the key to building stunning pitch decks is simplicity. Less is more. We want to focus on 2-3 of the most important things we've done. We don't get points for the "volume" of metrics on our traction slides, but rather the value of them.

In the case that our startup doesn't have much to put on our pitch deck traction slide then in some cases we may want to remove the slide altogether. This often occurs when we have a very early startup that may be at the idea stage. It's not ideal, but investors will understand at this stage.

But if we don't have any traction, our focus should be putting all of our efforts toward having something amazing to put in our traction slide between product, customers, and some crazy growth!

Find this article helpful?

This is just a small sample! Register to unlock our in-depth courses, hundreds of video courses, and a library of playbooks and articles to grow your startup fast. Let us Let us show you!

Submission confirms agreement to our Terms of Service and Privacy Policy.

Already a member? Login

No comments yet.

Start a Membership to join the discussion.

Already a member? Login